cryptoplace.site Community

Community

Books Of Peter Lynch

A proponent of value investing, Lynch wrote and co-authored a number of books and papers on investing strategies, including One Up on Wall Street, published by. Peter Lynch Audio Books ; to Earn · Learn to Earn ; the Street · Beating the Street ; Up On Wall Street · One Up On Wall Street ; Book of Investing Wisdom · The. Peter Lynch's Books · One Up On Wall Street by Peter Lynch One Up On Wall Street: How to Use What You Already Know to Ma · Beating the Street by Peter Lynch. Peter Lynch Books · One Up on Wall Street Book Summary By Peter Lynch in Hindi | BookPillow | Part 1 · One Up On Wall Street Book Summary By Peter. Peter Lynch is an American investor, mutual fund manager, and philanthropist. As the manager of the Magellan Fund at Fidelity Investments. Forbes Great Minds Of Business () by Smith, Fred; Lynch, Peter. Forbes Great Minds Of Business. by Fred Smith, Peter Lynch, Andrew Grove, Paul. Peter Lynch's last and most famous book is titles 'One up on Wall Street.' He starts by stating that nobody, not even the Wall Street jockeys, were born great. Writing with Rothchild (A Fool and His Money), Lynch, director of the Fidelity Magellan Fund, the nation's largest equity fund ($9 billion in assets). Lynch wrote "One Up on Wall Street," "Beating the Street," and "Learning to Earn," all of which are guides to investing, tracking, and reading the stock market. A proponent of value investing, Lynch wrote and co-authored a number of books and papers on investing strategies, including One Up on Wall Street, published by. Peter Lynch Audio Books ; to Earn · Learn to Earn ; the Street · Beating the Street ; Up On Wall Street · One Up On Wall Street ; Book of Investing Wisdom · The. Peter Lynch's Books · One Up On Wall Street by Peter Lynch One Up On Wall Street: How to Use What You Already Know to Ma · Beating the Street by Peter Lynch. Peter Lynch Books · One Up on Wall Street Book Summary By Peter Lynch in Hindi | BookPillow | Part 1 · One Up On Wall Street Book Summary By Peter. Peter Lynch is an American investor, mutual fund manager, and philanthropist. As the manager of the Magellan Fund at Fidelity Investments. Forbes Great Minds Of Business () by Smith, Fred; Lynch, Peter. Forbes Great Minds Of Business. by Fred Smith, Peter Lynch, Andrew Grove, Paul. Peter Lynch's last and most famous book is titles 'One up on Wall Street.' He starts by stating that nobody, not even the Wall Street jockeys, were born great. Writing with Rothchild (A Fool and His Money), Lynch, director of the Fidelity Magellan Fund, the nation's largest equity fund ($9 billion in assets). Lynch wrote "One Up on Wall Street," "Beating the Street," and "Learning to Earn," all of which are guides to investing, tracking, and reading the stock market.

In this book, Peter Lynch shows you how you can become an expert in a company and how you can build a profitable investment portfolio, based on your own. Peter Lynch · One Up on Wall Street: How To Use What You Already Know To Make Money In The Market. In Beating the Street, Lynch for the first time explains how to devise a mutual fund strategy, shows his step-by-step strategies for picking stock, and. Peter Lynch, One Up On Wall Street: How To Use What You Already Know To Make Money In The Market (Paperback). The Warren Buffett Way, 30th Anniversary Edition (Wiley Investment Classics) · Robert G. Hagstrom · (33) ; Beating the Street · Peter Lynch · (2,) ; Learn to Earn. In this book, Peter Lynch shows you how you can become an expert in a company and how you can build a profitable investment portfolio, based on your own. His books include One Up on Wall Street, Beating the Street, and Learn to Earn (all written with John Rothchild). Author Alerts. Get updates about Peter Lynch. One Up on Wall Street by Peter Lynch (). This is the first book written by the legendary portfolio manager at Fidelity, Peter Lynch, whose Magellan Fund. Book lists connected to Peter Lynch's books ; Kevin J. Davey That help to become a champion trader Book cover of Reminiscences of a Stock Operator ; Guy Thomas. Some great books by Peter Lynch include “Beating the Street,” “Learn to Earn” and “One Up on Wall Street.” Q. What are the best books on investing? A. The best. Peter Lynch has 56 books on Goodreads with ratings. Peter Lynch's most popular book is One Up On Wall Street: How to Use What You Already Know to. More than one million copies have been sold of this seminal book on investing in which legendary mutual-fund manager Peter Lynch explains the advantages. Peter Lynch ; Icon image One Up on Wall Street: How To Use What You Already Know To. One Up on Wall Street: How To Use What You Already Know To Make Money in the. Beating the Street by Peter Lynch is a comprehensive guide to successful stock investing. Lynch, a renowned investor and former manager of the Magellan Fund. Best Sellers ; Learn to Earn. By: Peter Lynch, John Rothchild; Narrated by: Peter Lynch ; One Up On Wall Street. By: Peter Lynch; Narrated by: Peter Lynch ; Un. Books by Peter Lynch ; One Up On Wall Street By Peter Lynch. One Up On Wall Street · € ; Learn to Earn By Peter Lynch. Learn to Earn · € ; Beating the. This is my book summary of Beating the Street by Peter Lynch. My summary and notes include the key lessons and most important insights from the book. Preface. This is my book summary of One Up On Wall Street by Peter Lynch. My summary and notes include the key lessons and most important insights from the book. Books by Peter Lynch ; One Up On Wall Street · · Simon&Schuster. Released: Jan 01, ; One Up On Wall Street: How To Use What You Already Know To.

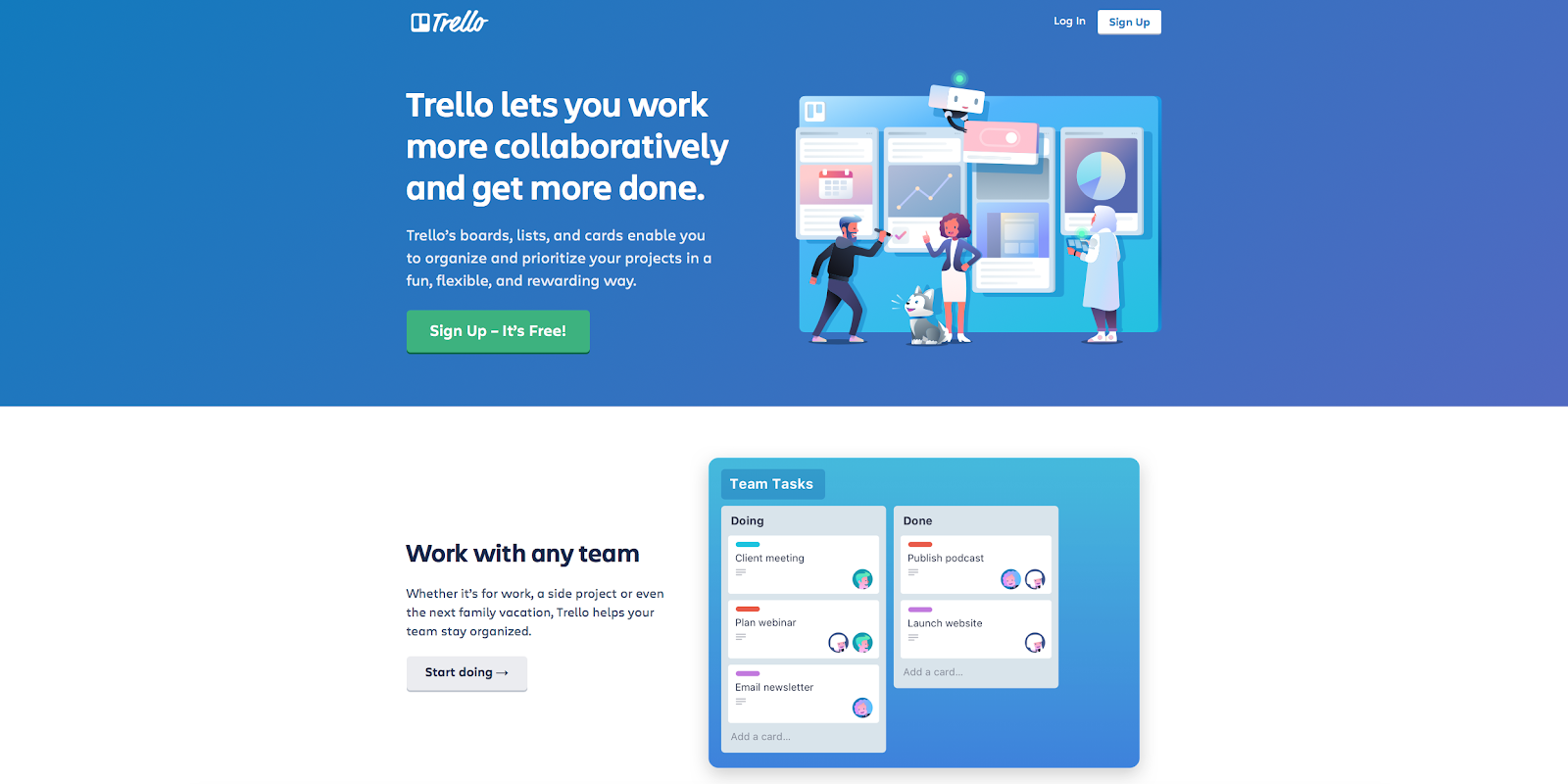

Trello Vs Asana Vs Notion

Compare Asana vs. Notion vs. Trello vs. Wrike using this comparison chart. Compare price, features, and reviews of the software side-by-side to make the. While Notion offers more versatility, Trello's simple and intuitive design makes managing tasks a breeze. If managing tasks is your primary concern, Trello is. Task Management: Notion lets you create Kanban-style boards, lists, and tables to manage tasks and projects, similar to Trello or Asana. You can. I wish it was more app friendly! I have to say I appreciate the seamlessness of Notion compared to this app. BUT, Notion is intimidating. Therefore, I loved. Flexibility: Trello is designed specifically for project management and offers a more structured approach to task management, while Notion is a more flexible. Asana is the easiest way for teams to track their work. From tasks and projects to conversations and dashboards, Asana enables teams to move work from start to. Monday vs Trello vs Notion vs Asana As a project manager, clients often ask me what the best project management platform is for their business. Compare Confluence vs Trello vs Asana vs Notion in Enterprise Wiki Software category based on reviews and features, pricing, support and more. In my experience, ClickUp is the most affordable app on this list, but it's not quite as user-friendly as Monday, Trello and Asana. I also have trouble locating. Compare Asana vs. Notion vs. Trello vs. Wrike using this comparison chart. Compare price, features, and reviews of the software side-by-side to make the. While Notion offers more versatility, Trello's simple and intuitive design makes managing tasks a breeze. If managing tasks is your primary concern, Trello is. Task Management: Notion lets you create Kanban-style boards, lists, and tables to manage tasks and projects, similar to Trello or Asana. You can. I wish it was more app friendly! I have to say I appreciate the seamlessness of Notion compared to this app. BUT, Notion is intimidating. Therefore, I loved. Flexibility: Trello is designed specifically for project management and offers a more structured approach to task management, while Notion is a more flexible. Asana is the easiest way for teams to track their work. From tasks and projects to conversations and dashboards, Asana enables teams to move work from start to. Monday vs Trello vs Notion vs Asana As a project manager, clients often ask me what the best project management platform is for their business. Compare Confluence vs Trello vs Asana vs Notion in Enterprise Wiki Software category based on reviews and features, pricing, support and more. In my experience, ClickUp is the most affordable app on this list, but it's not quite as user-friendly as Monday, Trello and Asana. I also have trouble locating.

Task Management: Notion lets you create Kanban-style boards, lists, and tables to manage tasks and projects, similar to Trello or Asana. You can. Asana vs Notion ; Workflow Management. ; Calendar Management. ; Project Planning. ; Collaboration Tools. ; User Satisfaction. User reviews12, Lightweight (Trello): Designed for short, temporary projects or teams with lightweight processes. · Midweight (Basecamp, Asana, Wrike): More elaborate tools. Which, puts it at a disadvantage when competing with the likes of Wrike vs Asana vs Trello and also vs cryptoplace.site So, if you're looking to enhance task. Teams can quickly adapt to the platform, resulting in faster implementation and increased productivity. On the other hand, Notion may require. In the past, Asana and Trello used to have distinct differences in their approach to task management, with Asana focusing on lists and Trello using boards. The whole team uses Asana for task management across departments. We use Trello to manage the product roadmap and workflow. Each department handles these tools. When comparing Asana vs Monday or Asana vs ClickUp, Asana wins across the board. Why? Because Monday and ClickUp are trying to be "all-in-one tools", meaning. trello has a much simpler interface and easy to learn for any team member. asana might have more features and configuration options but do you really need a. Round 1: Planning and Working Together: Notion is very flexible, but it might be too complicated for some people. Trello is the best for visual ease and working. Notion has Trello's Kanban-style project management functionality and levels up the process with endless customization tools and shareable docs. Features. Asana vs Trello ; Workflow Management. ; Assignment Management. ; Project Planning. ; Collaboration Tools. ; User Satisfaction. User reviews. Notion and Asana compared Asana is an established, top-rated project management tool released back in Its customers, which number in the millions. Notion has 62+ integrations, including Asana, Google Drive, Qonto, and Trello, while Asana offers + integrations like Google Drive, Canva, and Slack. Task. Researching Trello vs Asana? Choosing project management software is hard. Use our simple comparison chart to decide which one fits you best! When comparing Asana vs Monday or Asana vs ClickUp, Asana wins across the board. Why? Because Monday and ClickUp are trying to be "all-in-one tools", meaning. ClickUp is the #1 Asana and Trello alternative with more features and customization. Get better views and a flexible structure that scales with your team. For small teams or individuals working on simple projects with limited budgets, Trello is a great option. · For teams with more complex projects. Notion is a step up from Trello, Asana, or Monday. It seems like a great tool with a lot of functionality if you have the time to set it up and play around. Both Notion and Asana offer robust task management capabilities, but with slight differences. Notion allows you to create tasks within a database or a page.

What Is The Point Of A Vpn

VPN stands for “virtual private network” — a service that protects your internet connection and privacy online. VPNs create an encrypted tunnel for your. A VPN helps safeguard your employees' transmitted information by establishing a virtual point-to-point connection through the use of encryption, dedicated. When you switch on a VPN, it creates an encrypted connection (sometimes called a "tunnel") between your device and a remote server operated by the VPN service. A VPN helps safeguard your employees' transmitted information by establishing a virtual point-to-point connection through the use of encryption, dedicated. The purpose of a VPN is to create secure, private communications channels over shared, public networks. What type of attacks are prevented by a VPN? VPN. 1. Point-to-Point Tunneling Protocol (PPTP) PPTP is one of the oldest protocols still active on the internet. Created by Microsoft, it uses the Transmission. VPN stands for “virtual private network” – a service that encrypts your internet traffic and protects your online identity. Find out how it works. The benefits of using a VPN are vast. One of the most important is the fact that businesses can effectively secure their network. A virtual private network (VPN) provides secure connectivity between two sites or a remote user and the headquarters network. All traffic between the two. VPN stands for “virtual private network” — a service that protects your internet connection and privacy online. VPNs create an encrypted tunnel for your. A VPN helps safeguard your employees' transmitted information by establishing a virtual point-to-point connection through the use of encryption, dedicated. When you switch on a VPN, it creates an encrypted connection (sometimes called a "tunnel") between your device and a remote server operated by the VPN service. A VPN helps safeguard your employees' transmitted information by establishing a virtual point-to-point connection through the use of encryption, dedicated. The purpose of a VPN is to create secure, private communications channels over shared, public networks. What type of attacks are prevented by a VPN? VPN. 1. Point-to-Point Tunneling Protocol (PPTP) PPTP is one of the oldest protocols still active on the internet. Created by Microsoft, it uses the Transmission. VPN stands for “virtual private network” – a service that encrypts your internet traffic and protects your online identity. Find out how it works. The benefits of using a VPN are vast. One of the most important is the fact that businesses can effectively secure their network. A virtual private network (VPN) provides secure connectivity between two sites or a remote user and the headquarters network. All traffic between the two.

VPN Benefits · Global Connectivity and Point-to-Point Remote Access · Enhanced Productivity · Security for Data in Transit · Longstanding, Durable Technology. VPN and HTTPS: Which Is Needed for Business Internet Security? ; Protects data in transit, Conceals in-transit information, user identity, and online behavior. What are VPN protocols? · Point-to-Point Tunneling Protocol (PPTP) · Layer 2 Tunnel Protocol (L2TP/IPSec) · OpenVPN · Secure Socket Tunneling Protocol (SSTP). Permitting remote access. A VPN allows you to create a private remote network of select devices which is ideal for remote workers. · Better security · Bypassing. The core of a VPN is to provide a secure connection to the internet and protect your data by encrypting your traffic. But VPNs have become more. A VPN is created by establishing a virtual point-to-point connection through the use of dedicated circuits or with tunneling protocols over existing networks. A. VPN use cases including secure remote access and secure site-to-site connectivity. Enterprise VPNs have two primary use cases: secure remote access and secure. A VPN works by establishing a secure, point-to-point connection between the remote client and a VPN server connected to the target network. Once established, a. A VPN is an adequate means of securing branch or remote employees on a smaller scale. · Back when everyone went to the office, companies would even employ site-. A VPN, or Virtual Private Network, is a tool that encrypts your internet traffic and hides your IP (Internet Protocol) address to ensure a secure and private. A VPN is designed to create an encrypted tunnel between two points. Both endpoints have a shared secret key, which allows them to encrypt their outgoing traffic. A VPN adds a layer of privacy protection to your online activities by routing your traffic through an encrypted tunnel between you and anyone who tries to spy. A virtual private network (VPN) is designed to fix this problem. It provides a secure, private connection between two points communicating over a public. What are the drawbacks of using VPNs for access control? 1. Single point of failure. Attackers cannot monitor VPN-encrypted traffic from outside the VPN. Internet Protocol (IP) address leak prevention: The core purpose of a VPN is to hide or disguise a user's IP address and prevent anyone from tracking their. A VPN is used primarily for the purpose of securing remote access to the internet. VPN services have many applications, and we'll describe the most important. A virtual private network (VPN) conceals internet data traveling to and from your device. VPN software lives on your devices — whether that's a computer. What are VPN protocols? · Point-to-Point Tunneling Protocol (PPTP) · Layer 2 Tunnel Protocol (L2TP/IPSec) · OpenVPN · Secure Socket Tunneling Protocol (SSTP). How do VPNs work? At its most basic level, VPN tunneling creates a point-to-point connection inaccessible to unauthorized users. To create the tunnel, VPNs. VPNs encrypt your data, ensuring that your ISP cannot view your online activity. At the same time, a VPN hides your IP address, making it impossible to trace.

Best Brokerage For Index Funds

Fidelity and Vanguard are arguably the best brokerages for mutual fund index funds. Each of these brokerages has its own family of mutual funds that you can. If you have less than $ to invest, but at least $, then Schwab is a great place to start. They have two stock index funds for US. Best Online Brokers for Index Funds · 1. Best for Low Fees: Interactive Brokers · 2. Best for Well-Funded Investors: Frec · 3. Best for Retirement Savers. iShares Core S&P ETF IVV · Vanguard Total Stock Market Index VTSAX · Vanguard Tax-Managed Capital Appreciation VTCLX · Vanguard FTSE All-World ex-US ETF VEU. *Exchange, clearing, and regulatory fees still apply for all opening and closing trades. All futures options and the following index products are excluded. Brokerage firms that offer index funds are able to charge lower fees for index funds because they put fewer hours into managing them. Index funds don't. You can start investing in index funds with one of the best online brokers and trading platforms, such as the ones below: Compare the Best Online Brokers. Compare index funds vs. actively managed funds. Not all index funds are Vanguard funds not held in a brokerage account are held by The Vanguard. Top 10 online brokers in Canada: our picks ; $ None. N/A ; 1¢ per shareMin. $ per trade. None. CAD and USD investments. Fidelity and Vanguard are arguably the best brokerages for mutual fund index funds. Each of these brokerages has its own family of mutual funds that you can. If you have less than $ to invest, but at least $, then Schwab is a great place to start. They have two stock index funds for US. Best Online Brokers for Index Funds · 1. Best for Low Fees: Interactive Brokers · 2. Best for Well-Funded Investors: Frec · 3. Best for Retirement Savers. iShares Core S&P ETF IVV · Vanguard Total Stock Market Index VTSAX · Vanguard Tax-Managed Capital Appreciation VTCLX · Vanguard FTSE All-World ex-US ETF VEU. *Exchange, clearing, and regulatory fees still apply for all opening and closing trades. All futures options and the following index products are excluded. Brokerage firms that offer index funds are able to charge lower fees for index funds because they put fewer hours into managing them. Index funds don't. You can start investing in index funds with one of the best online brokers and trading platforms, such as the ones below: Compare the Best Online Brokers. Compare index funds vs. actively managed funds. Not all index funds are Vanguard funds not held in a brokerage account are held by The Vanguard. Top 10 online brokers in Canada: our picks ; $ None. N/A ; 1¢ per shareMin. $ per trade. None. CAD and USD investments.

Charles Schwab Investment Management, Inc., dba Schwab Asset Management™, is the investment advisor for Schwab Funds. Charles Schwab & Co., Inc. (Schwab). Account minimum: Charles Schwab offers low-cost index funds and ETFs with no account minimums or maintenance fees. Commission and other fees. Index funds are traded with the fund manager, so you're all but guaranteed to have a buyer for your shares (although you won't know the exact price you will. Ready to rethink what's possible? To invest today, select the option that best describes you: The Index does not charge management fees or brokerage expenses. Fidelity, our best overall ETF brokerage, delivers extensive ETF research, screening with more than 90 factors, and an ETF Portfolio Builder with no account or. broker or advisor. Clients should contact their introducing broker or advisor about the rates that will apply to their account. ×. Which Plan is Best for You? funds are considered a single population for comparison purposes The Index does not charge management fees or brokerage expenses, nor does the Index. Hargreaves Lansdown: Best online broker for UK index funds · Interactive Investor: Fixed-fee index fund investing · AJ Bell: Best for low-cost index fund. For example, Charles Schwab's S&P Index Fund (SWPPX) is a straightforward option with no investment minimum. Its expense ratio is %, meaning every. You can also purchase an S&P index fund through a brokerage account and hold it either in an individual retirement account or a taxable account. You'll find. Fidelity and Vanguard are arguably the best brokerages for mutual fund index funds. Each of these brokerages has its own family of mutual funds that you can. ETFs vs mutual funds: A comparison. There are funds for every investor. Find Vanguard funds not held in a brokerage account are held by The Vanguard. Plus, we offer 24/7 customer service online or by phone2 and were named Barron's , , and Best Online Broker3. A wide range of choices. We offer. There are currently more than mutual funds bearing the Vanguard name. Along with the world's oldest index mutual fund — the Vanguard — there are funds. investments, whether it's an online brokerage or within your (k). The Generally, if you want to “set it and forget it,” index funds are a good bet. Best Investment Brokerage Platform for Exchange-Traded Funds (ETFs) ABF Singapore Bond Index Fund, Bonds, %. Phillip Sing Income ETF, Equities. It is very easy. Go to any major investment company, such as: Fidelity Investments - Retirement Plans, Investing, Brokerage. Best Online Brokers for ETFs: Fees, Reputation and Services · Vanguard: Vanguard is one of the largest investment management companies and offers a wide range of. Those traders who want to invest in S&P and thus gain exposure to all the stocks in it may do so through mutual funds or exchange-traded funds (ETFs). At Wells Fargo, you can invest in funds directly, through a brokerage account, or through an experienced financial professional More resources. Compare ways.

Hybrid Trading

We Trade Strategies Differently by Defining RISK with CONTRA Trades. Stop Trading the same OLD Strategies!!! Focus on RISK first as Profit is by Product!!! Many forex brokers rely on a hybridized model for processing client transactions. This approach does provide several inherent benefits as they provide traders. A Hybrid Market is a security exchange that combines the features of both an electronic trading system and a traditional floor-based trading. Past performance is not necessarily indicative of future results. The risk of loss in trading commodity futures, options, and foreign exchange (“forex”) is. Electronic and hybrid trading platform development28Stone designs, builds and delivers electronic trading solutions for our clients. Our team of industry. 24 x DC Unlock the Multiverse: Chapter 3 hybrid trading card packs. · HYBRID TRADING CARDS: Each physical trading card is uniquely minted and connected to a K Followers, Following, Posts - Hybrid Trading (@hybridtradingfx) on Instagram: " • We help YOU get funded using our Hybrid Strategy • No. System as said before works in all trading sessions, 24 hours a day. Important rule for placing trades are that on every entry you place 2 trades and split your. Popular videos · Best Way to Use MTF | eMargin · Learn the Art of True Stock Market Trading from a NEW-BIE · Join my Non-Traditional Trading with Contra. We Trade Strategies Differently by Defining RISK with CONTRA Trades. Stop Trading the same OLD Strategies!!! Focus on RISK first as Profit is by Product!!! Many forex brokers rely on a hybridized model for processing client transactions. This approach does provide several inherent benefits as they provide traders. A Hybrid Market is a security exchange that combines the features of both an electronic trading system and a traditional floor-based trading. Past performance is not necessarily indicative of future results. The risk of loss in trading commodity futures, options, and foreign exchange (“forex”) is. Electronic and hybrid trading platform development28Stone designs, builds and delivers electronic trading solutions for our clients. Our team of industry. 24 x DC Unlock the Multiverse: Chapter 3 hybrid trading card packs. · HYBRID TRADING CARDS: Each physical trading card is uniquely minted and connected to a K Followers, Following, Posts - Hybrid Trading (@hybridtradingfx) on Instagram: " • We help YOU get funded using our Hybrid Strategy • No. System as said before works in all trading sessions, 24 hours a day. Important rule for placing trades are that on every entry you place 2 trades and split your. Popular videos · Best Way to Use MTF | eMargin · Learn the Art of True Stock Market Trading from a NEW-BIE · Join my Non-Traditional Trading with Contra.

HYBRID TRADING. We're offering you the opportunity to join a highly-exclusive community of traders who follow a hybrid trading system that's capable of keeping. The vFairs hybrid trade show platform combines in-person and virtual events to help businesses generate leads and opportunities. 12 votes, 10 comments. The complexity and nuance of trade management/continuous monitoring has led me towards going towards a moveable. Re: BeatlemaniaSA's XU-Hybrid Trading System · 3 by BeatlemaniaSA · samuelkanu wrote: Mon Jan 24, pm Thanks for opening. The Hybrid Trading is established in , we have earned a reputation for our commitment to quality, reliability, and customer satisfaction. Uncover the secrets of scalping using the Hybrid System in this all course. Bringing together years of expertise, in Hybrid System Trading into a to understand. Trading Paints adds custom car liveries to iRacing. Design your own cars or race with pre-made paint schemes shared from the community of painters. A hybrid forex trading system combines the advantages of mechanical and discretionary systems. Automated technical analysis software. For traders, by traders. DC | Hro Chapter 4 Hybrid Trading Cards Collection: 4-Pack Premium Booster Box, 29 Cards. The CQG trade systems tool gives us the functionality to create trade systems with a lot of build in functionality such as canned exits, trailing stops. Hybrid securities are bought and sold on an exchange or through a brokerage. Hybrids may give investors a fixed or floating rate of return and may pay returns. The “Hybrid Model” Used By Forex Brokers · Offset orders with other customers · Hedge orders with an external counterparty (liquidity providers) · Or not hedge and. Hybrid Solutions has led the industry as an independent trading technology provider since We specialize in designing comprehensive trading solutions that. Hybrid Trading System. likes. We are a team of three: A Quant, Trader and a Programmer. Our objective is to guide people to master trading while. HYBRID TRADER | YOU TUBER | VOLATILITY TRADER's posts My HERO or ZERO Ratio Spread Skeleton with DATA Points. Please re-tweet as it takes a lot to create this. BullX is a hybrid telegram trading bot that works on all devices, including your phones, desktops, inside the telegram itself, and any device you can imagine. Go Hybrid, Trade with Compatible Trading. Your trading journey starts here. Deposit, Trade, Withdraw in all listed Cryptocurrencies. This playlist includes videos that will help you the trader understand concepts discussed in the live streams. Each video explains the key concepts with. When the large size from one combines with the color of another, ideal caviar pearls come to fruition. Browne Trading carries a variety of hybrid sturgeon.

Orcc Stock

Owl Rock Capital Corp (NYSE:ORCC) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest changes. Stock Price, News, Quote and Profile of Owl Rock Capital Corporation(NYSE:ORCC) stock. General stock ratings, overview and activity description. View today's Owl Rock Capital Corp stock price and latest OBDC news and analysis. Create real-time notifications to follow any changes in the live stock. Previous Ticker Symbol: ORCC Changed: 6/22/ Previous Name: Owl Rock Capital Corp Changed: 6/22/ Large Cap Stock - Market Value $ Million. Click for. Owl Rock Capital Corp (ORCC) dividend profitability grade and underlying summary. Charts: gross margin, PE, PEG, Net Income, EBITDA, ROE, ROA, etc. ORCC Stock Price Chart Interactive Chart > · Price chart for ORCC. Owl Rock Capital Corporation (ORCC) Company Bio. Owl Rock Capital Corporation provides asset. Owl Rock Capital Corp, non traded business development company, seeks investment opportunities in middle market companies located in the US with an EBITDA. Owl Rock Capital Corporation ("ORCC") is a specialty finance company focused on providing direct lending solutions to middle market companies. Owl Rock (ORCC) PT Lowered to $15 at Raymond JamesRaymond James analyst Robert Dodd lowered the price target on Owl Rock (NYSE: ORCC) to $ (from $). Owl Rock Capital Corp (NYSE:ORCC) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest changes. Stock Price, News, Quote and Profile of Owl Rock Capital Corporation(NYSE:ORCC) stock. General stock ratings, overview and activity description. View today's Owl Rock Capital Corp stock price and latest OBDC news and analysis. Create real-time notifications to follow any changes in the live stock. Previous Ticker Symbol: ORCC Changed: 6/22/ Previous Name: Owl Rock Capital Corp Changed: 6/22/ Large Cap Stock - Market Value $ Million. Click for. Owl Rock Capital Corp (ORCC) dividend profitability grade and underlying summary. Charts: gross margin, PE, PEG, Net Income, EBITDA, ROE, ROA, etc. ORCC Stock Price Chart Interactive Chart > · Price chart for ORCC. Owl Rock Capital Corporation (ORCC) Company Bio. Owl Rock Capital Corporation provides asset. Owl Rock Capital Corp, non traded business development company, seeks investment opportunities in middle market companies located in the US with an EBITDA. Owl Rock Capital Corporation ("ORCC") is a specialty finance company focused on providing direct lending solutions to middle market companies. Owl Rock (ORCC) PT Lowered to $15 at Raymond JamesRaymond James analyst Robert Dodd lowered the price target on Owl Rock (NYSE: ORCC) to $ (from $).

The Owl Rock Capital Corp. stock price is closed at $ with a total market cap valuation of $ B (M shares outstanding). The Owl Rock Capital Corp. Stock info · Stock chart & quote · Charts · Historical data · Analyst coverage ORCC”) to Blue Owl Capital Corporation (“OBDC”) and Owl Rock is now known as. ORCC's Cost of Equity, calculated using the formula Risk-Free Rate + Beta x ERP, stands at %. The Beta, indicating the stock's volatility relative to. Analyst Blue Owl Capital Corp stock forecast, for symbol ORCC forward target price, presented by The Online Investor. is $ (NYSE) as of Aug EDT. Owl Rock Capital Corp (ORCC) has given a return of % in the last 3 years. ORCC Stock Financial Analysis - Owl Rock Capital Corp (NYSE) Stock · Income Statement: Revenue, Operating Income, Net Income · Income Statement: EPS · Cash Flow. Stock Price and Dividend Data for Owl Rock Capital Corp (ORCC), including dividend dates, dividend yield, company news, and key financial metrics. Looking to buy ORCC Stock? View today's ORCC stock price, trade commission-free, and discuss Owl Rock Capital Corp stock updates with the investor. 6/30/, 9/30/, 12/31/, 3/31/ NAV/Share: $, $, $, $ Debt/Equity: , , , NOI/Share: $, $, $ (“ORCC”) today announced that it priced its initial public offering of 10,, shares of common stock at $ per share. Shares of common stock of ORCC. Find the latest Owl Rock Capital Corp (cryptoplace.site) stock quote, history, news and other vital information to help you with your stock trading and investing. Find the latest Blue Owl Capital Inc. (OWL) stock quote, history, news and other vital information to help you with your stock trading and investing. Owl Rock Capital stock quote and ORCC charts. Latest stock price today and the US' most active stock market forums. Shares of Online Resources Corporation (Nasdaq:ORCC) were gapping down Wednesday morning with an open price % lower than Tuesday's closing price. The stock. ORCC. ORCC - ORCC STOCK NEWS. Welcome to our dedicated page for ORCC news (Ticker: ORCC), a resource for investors and traders seeking the latest updates and. Dividend capture strategy is based on ORCC's historical data. Past performance is no guarantee of future results. Step 1: Buy ORCC shares 1 day before the ex-. Shares of Online Resources Corporation (Nasdaq:ORCC) were gapping down Wednesday morning with an open price % lower than Tuesday's closing price. The stock. See “Recent Developments – Capital Drawdown Notice.” Our common shares have been approved for listing on the New York Stock Exchange under the symbol “ORCC.” In. Should You Buy or Sell Owl Rock Capital Stock? Get The Latest ORCC Stock Analysis, Price Target, Dividend Info, Headlines, and Short Interest at MarketBeat. ORCC. ORCC - ORCC STOCK NEWS. Welcome to our dedicated page for ORCC news (Ticker: ORCC), a resource for investors and traders seeking the latest updates and.

Top 0 Percent Credit Cards

0% APR Credit Cards · Citi® Diamond Preferred® Card · Capital One Quicksilver Cash Rewards Credit Card · Citi Double Cash® Card · Citi Custom Cash® Card · Capital. 14 Best 0% interest credit cards of September · + Show Summary · Wells Fargo Reflect® Card · Capital One SavorOne Cash Rewards Credit Card · Discover. Discover the best zero interest credit cards of September with 0% APR offers on purchases and balance transfers. Compare top cards to find the perfect fit. Make purchases interest-free for 12 months or more with our selection of the best 0% APR business credit cards. Best 0% APR Credit Cards of September · Best in Cash Back and No Annual Fee Credit Cards. Discover it® Cash Back · Citi Rewards+® Card · Citi Rewards+®. Top balance transfer credit cards · Top 0% APR credit cards · Top travel rewards cards · Compare the top credit cards · Top cash back credit cards · Top rewards. Zero-interest credit cards can be a big help. Here's everything you need to know to make them work for you. Best 0% Intro APR on Purchases Credit Card Offers · Discover it® Miles · Citi Rewards+ Card · Wells Fargo Reflect Card · Capital One VentureOne Rewards Credit Card. The Ink Business Unlimited offers a generous flat rate of cash back and no annual fee. 4 min read Aug 13, woman laying on couch. 0% APR Credit Cards · Citi® Diamond Preferred® Card · Capital One Quicksilver Cash Rewards Credit Card · Citi Double Cash® Card · Citi Custom Cash® Card · Capital. 14 Best 0% interest credit cards of September · + Show Summary · Wells Fargo Reflect® Card · Capital One SavorOne Cash Rewards Credit Card · Discover. Discover the best zero interest credit cards of September with 0% APR offers on purchases and balance transfers. Compare top cards to find the perfect fit. Make purchases interest-free for 12 months or more with our selection of the best 0% APR business credit cards. Best 0% APR Credit Cards of September · Best in Cash Back and No Annual Fee Credit Cards. Discover it® Cash Back · Citi Rewards+® Card · Citi Rewards+®. Top balance transfer credit cards · Top 0% APR credit cards · Top travel rewards cards · Compare the top credit cards · Top cash back credit cards · Top rewards. Zero-interest credit cards can be a big help. Here's everything you need to know to make them work for you. Best 0% Intro APR on Purchases Credit Card Offers · Discover it® Miles · Citi Rewards+ Card · Wells Fargo Reflect Card · Capital One VentureOne Rewards Credit Card. The Ink Business Unlimited offers a generous flat rate of cash back and no annual fee. 4 min read Aug 13, woman laying on couch.

Get 0% APR credit cards to help you with large purchases or unforeseen expenses. 0% introductory APR cards also have the potential to save you hundreds of dollars when you transfer debt with high interest rates. The best 0% APR cards offer. The MBNA True Line Mastercard's lack of annual fee, impressive 0% interest rate on balance transfers and % interest rate on purchases are what make it our. Compare and find the best credit cards in Canada within minutes. Find the perfect credit card for your needs with our easy-to-use tool to maximize rewards. Wells Fargo Reflect® Card: Best for Longest 0% intro period · BankAmericard® credit card: Best for Long intro period + straightforward benefits · U.S. Bank Visa®. TD FlexPay Credit Card · Our best balance transfer offer: 0% intro APR for first 18 billing cycles after account opening. After that, %–% variable APR. A 0% APR credit card offers no interest for a period of time, typically six to 21 months. During the introductory no interest period, you won't incur interest. Some of the best 0% APR cards come with promotional periods of 15 months or more. Several such cards let you earn rewards or cash back. Discover how 0% and low APR credit cards can help boost your credit. card and bills 24/7 with Online Banking and our top-rated Mobile App. Plus, a credit card with us could help you increase your share of our Profit Payout*. 0% intro APR on purchases and balance transfers for 15 months; % - % variable APR after that; balance transfer fee applies. Best card for 0% APR on purchases for first year · e.g. Amex BCP $8, limit, May · e.g. Chase Freedom Flex $10, limit, June Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that, 0% intro APR for 15 months; % - % variable. Zero Percent Balance Transfer Credit Card Offers provide a way to gain significant traction in your Debt Freedom March. Discover how 0% and low APR credit cards can help boost your credit. Best 0% credit cards ; MBNA Only purchases made in the first 60 days are interest-free ; MoneySavingExpert's 0% Spending Card Eligibility Calculator, with the The APR can start at 0% (usually an introductory offer with an expiration date) and generally tops out around %. APR is determined by what the credit card. The right card can maximize rewards and minimize costs ; Chase Slate. 0% on balance transfers and purchases for 15 months, % to % after that. $0 ( Take advantage of no interest payments. Get matched to intro 0% APR credit cards from our partners based on your unique credit profile. The 8 best 0% APR credit cards can help you pay down debt over time or tackle a big upcoming purchase. We have the details.

Open Ira To Avoid Paying Taxes

You must be 59½ years old to start withdrawing the earnings on contributions or you must pay taxes and penalties. Also, to avoid taxes, the funds must be in the. An IRA is not an investment. It's an account type that allows for tax-deferred or tax-free growth on your retirement savings contributions. You can open an IRA. Regarding the ability to open IRA to reduce taxes, you might be able to contribute deductible amounts to an IRA. It depends on your income. Generally, Roth IRA withdrawals are not taxable for federal income tax purposes, if the individ- ual has had the retirement account for more than five years and. You may want to open a Roth IRA to take advantage of tax-free withdrawals when you retire. Just the thought of those earnings accumulating for 20 to 30 years. Roth or traditional: Which is right for you? · No immediate tax benefit for contributing · Contributions can be withdrawn at any time tax- and penalty-free. Traditional IRAs involve making tax-free contributions, meaning you contribute to your IRA before taxes are taken out. This may reduce your taxable income. You may be able to claim a deduction on your income tax return for the amount you contributed to your IRA. We generally follow the IRS when it comes to. At retirement, the distributions will be tax-free. The Traditional IRA saver will pay taxes when they take distributions, but because they are not paying taxes. You must be 59½ years old to start withdrawing the earnings on contributions or you must pay taxes and penalties. Also, to avoid taxes, the funds must be in the. An IRA is not an investment. It's an account type that allows for tax-deferred or tax-free growth on your retirement savings contributions. You can open an IRA. Regarding the ability to open IRA to reduce taxes, you might be able to contribute deductible amounts to an IRA. It depends on your income. Generally, Roth IRA withdrawals are not taxable for federal income tax purposes, if the individ- ual has had the retirement account for more than five years and. You may want to open a Roth IRA to take advantage of tax-free withdrawals when you retire. Just the thought of those earnings accumulating for 20 to 30 years. Roth or traditional: Which is right for you? · No immediate tax benefit for contributing · Contributions can be withdrawn at any time tax- and penalty-free. Traditional IRAs involve making tax-free contributions, meaning you contribute to your IRA before taxes are taken out. This may reduce your taxable income. You may be able to claim a deduction on your income tax return for the amount you contributed to your IRA. We generally follow the IRS when it comes to. At retirement, the distributions will be tax-free. The Traditional IRA saver will pay taxes when they take distributions, but because they are not paying taxes.

Roth IRA. Contribute after-tax money and avoid paying taxes when you withdraw money from your account Open an IRA in. Roth IRA contributions aren't tax-deductible. Unlike contributions to other tax-advantaged retirement accounts, you won't get an upfront tax benefit from those. While each has specific advantages, the main benefit of an IRA is that you might be able to avoid paying taxes on the interest you earn until you withdraw your. If you're not covered by a workplace retirement plan, you can typically deduct the full amount of your IRA contribution, regardless of income. However, if you. Generally, if you withdraw money from your IRA before age 59½, you will incur a 10% penalty plus ordinary income tax on the amount attributable to previously. Depending on your situation, you might not pay income taxes on the money you contribute to tax-deferred retirement accounts. When you withdraw the money in. Roth IRA rules · You must designate the account as a Roth IRA when you start the account. · You can't deduct your contributions to a Roth IRA on your tax return. While it is possible, it generally does not make sense to use the retirement assets to pay the taxes. If you are under age 59 1/2, the amount distributed to pay. Converting a traditional IRA to a Roth IRA typically means paying significant taxes, but making a charitable contribution can help offset that income. This. Deductions vary according to your modified adjusted gross income (MAGI) and whether or not you're covered by a retirement plan at work. If you (and your spouse. Also, if you are under age 59 ½ you may have to pay an additional 10% tax for early withdrawals unless you qualify for an exception. Roth IRAs. Not required if. A traditional IRA is an individual retirement account (IRA) designed to help people save for retirement, with taxes deferred on any potential investment growth. With traditional IRAs, you delay paying any taxes until you withdraw funds from your account later in retirement. With Roth IRAs, however, you pay taxes upfront. Roth IRA contributions aren't tax-deductible. Unlike contributions to other tax-advantaged retirement accounts, you won't get an upfront tax benefit from those. A traditional IRA is a type of individual retirement account that lets your earnings grow tax-deferred.* You pay taxes on your investment gains only when. There are income requirements for opening a Roth IRA, which are funded with after-tax dollars. Your earnings and withdrawals are not taxed in retirement.. When. With a Roth IRA, you could potentially avoid paying income tax on qualified withdrawals, plus there are no mandatory cryptoplace.sitete 1. Roth IRA Account. Since you've already paid the tax due, you usually don't pay tax on your distributions. Social Security. Virginia does not tax Social Security benefits. If any. A traditional IRA is a tax-deferred retirement savings account; you pay taxes on the money in your account only when you make withdrawals in retirement. This is.

Reward Points Tracker App

AwardWallet helps you track frequent flyer miles and hotel points as well as book reward tickets. Rewards Points. A type of incentive earned through making purchases in select cryptoplace.sitee user rating. All apps · Leaders. GetApp offers objective. Travel Freely app can track your rewards credit cards, points and miles earned, and organize your cards for max rewards. You'll earn a reward when you connect a tracker to your UHC Rewards account. To connect a tracker: 1. Sign in to the UnitedHealthcare app and navigate to the. Mobile and app · Planes · Lounges · Bags · International travel · Special assistance tracking information; Your information will not be used for any other. Windows 11 apps. Microsoft Store. Account profile · Download Center · Microsoft Store support · Returns · Order tracking · Certified Refurbished · Microsoft. Wishfin is a financial technology company that offers a credit card tracking app to help users manage and track their credit cards. The app. The Exxon Mobil Rewards+ app allows you to easily earn, track and redeem points for savings and provides multiple secure ways to pay at the pump and inside the. CardPointers will save you money and earn you more cash back, points, and miles every day by maximizing credit card spend bonuses, offers, and welcome bonuses. AwardWallet helps you track frequent flyer miles and hotel points as well as book reward tickets. Rewards Points. A type of incentive earned through making purchases in select cryptoplace.sitee user rating. All apps · Leaders. GetApp offers objective. Travel Freely app can track your rewards credit cards, points and miles earned, and organize your cards for max rewards. You'll earn a reward when you connect a tracker to your UHC Rewards account. To connect a tracker: 1. Sign in to the UnitedHealthcare app and navigate to the. Mobile and app · Planes · Lounges · Bags · International travel · Special assistance tracking information; Your information will not be used for any other. Windows 11 apps. Microsoft Store. Account profile · Download Center · Microsoft Store support · Returns · Order tracking · Certified Refurbished · Microsoft. Wishfin is a financial technology company that offers a credit card tracking app to help users manage and track their credit cards. The app. The Exxon Mobil Rewards+ app allows you to easily earn, track and redeem points for savings and provides multiple secure ways to pay at the pump and inside the. CardPointers will save you money and earn you more cash back, points, and miles every day by maximizing credit card spend bonuses, offers, and welcome bonuses.

Though not required, connect a tracker and get access to even more reward activities The UnitedHealthcare® app is available for download for iPhone® or. With Fetch, you can get free gift cards simply for shopping, snapping all your receipts and playing games on your phone! Try our rewards app today. Track your class's rewards with this handy app. At the end of each day you reward your class with 'experience points'. When they reach the required amount they. Earth Rewards is a green app and carbon footprint calculator that helps you track and offset your carbon footprint and protects the Amazon rainforest too. The 5 Credit Card Apps Best for Tracking Rewards · 1. AwardWallet · 2. MaxRewards · 3. Uthrive · 4. CardPointers · 5. Waly. Waly says. Reward: Staff App Note: Video may display a previous version of the software. See article below for more recent images. LiveSchool gives you a school-wide platform for points tracking. Students earn points for positive behavior and cash it in for rewards. The best apps to track your credit card rewards are AwardWallet, Max Rewards and The Points Guy app. AwardWallet is the one supports most. With Chase Ultimate Rewards, you can redeem the points you've earned for travel, experiences, merchandise, gift cards and even cash back. One tap takes you there. Download the new IHG One Rewards app to enjoy faster booking, personalized rewards and travel made easy. CardPointers will save you money and earn you more cash back, points, and miles every day by maximizing credit card spend bonuses, offers. TPG app. Improve earnings, maximize rewards and track progress toward dream trips. Plus, your own feed of TPG content. TPG points valuation. See what a point or. Earn a stack of welcome rewards instantly when you sign up with the SmartRewards app. Fuel reward*. Get 20 cents off per gallon on your first five fill ups*. Your points are good for one year after earning, so use them to redeem free items listed in the Rewards catalog. Benefits. The RaceTrac Rewards app lets you. Create your own loyalty and rewards program to turn first-time customers into forever customers · Encourage repeat purchases by rewarding every order with points. Several websites, including Traxo, AwardWallet, UsingMiles, and PointHub, keep tabs on your rewards programs for free. Other sites, such as TripIt Pro, charge. Score AARP Rewards points when you sync a fitness tracker or health app with AARP Rewards. Once connected, you'll earn points daily for hitting steps. Middle of phone with Exxon Mobil Rewards+ gas app displayed with gas rewards points visible This website uses cookies and other tracking technologies. app, or tablet. HOW IT WORKS. Give Points. Easily recognize students for positive behavior with the PBIS Rewards App. Student recognition is as quick as. Eat, earn & redeem · Eat: Get 5 points for every qualified dollar you spend on food and non-alcoholic beverages at Outback Steakhouse, Carrabba's Italian Grill.

Secured Credit Card With Poor Credit

It looks and acts like a traditional credit card except that you provide a refundable security deposit, which will equal your credit line, of at least $ Pros and cons of using a secured credit card ; May charge you high fees and interest charges if you fail to make payments on time · Has a low credit limit. OpenSky® Plus Secured Visa® Credit Card No credit check to apply. Find out instantly if you are approved- Zero credit risk to apply! Secured credit cards function much like standard or unsecured credit cards, but they require you to make a deposit up front, usually in the same amount as your. Secured credit cards work much like standard ones in that they allow you to make in-store and online purchases, pay utility bills, or book a vacation. They also. Highlights - Capital One Platinum Secured Credit Card · No Security Deposit All the benefits of a Mastercard, without a security deposit · Easy Access 24/7 access. The DCU Visa® Platinum Secured Credit Card is a secured card for bad credit, but it offers a lower interest rate than many unsecured cards for people with good. Secured Credit Cards · Don't be late on your payments, miss payments or default on your debt. 35% of your credit score is based upon your payment history. · Don't. Secured credit cards are great tools for building credit because they typically have more relaxed credit requirements than unsecured cards, which. It looks and acts like a traditional credit card except that you provide a refundable security deposit, which will equal your credit line, of at least $ Pros and cons of using a secured credit card ; May charge you high fees and interest charges if you fail to make payments on time · Has a low credit limit. OpenSky® Plus Secured Visa® Credit Card No credit check to apply. Find out instantly if you are approved- Zero credit risk to apply! Secured credit cards function much like standard or unsecured credit cards, but they require you to make a deposit up front, usually in the same amount as your. Secured credit cards work much like standard ones in that they allow you to make in-store and online purchases, pay utility bills, or book a vacation. They also. Highlights - Capital One Platinum Secured Credit Card · No Security Deposit All the benefits of a Mastercard, without a security deposit · Easy Access 24/7 access. The DCU Visa® Platinum Secured Credit Card is a secured card for bad credit, but it offers a lower interest rate than many unsecured cards for people with good. Secured Credit Cards · Don't be late on your payments, miss payments or default on your debt. 35% of your credit score is based upon your payment history. · Don't. Secured credit cards are great tools for building credit because they typically have more relaxed credit requirements than unsecured cards, which.

PREMIER Bankcard® Mastercard® Credit Card · Merit Platinum Card · Secured Chime Credit Builder Visa® Credit Card · Surge Mastercard® Credit Card · Self - Credit. Consider a secured credit card: You provide the lender with a cash deposit and in return you are issued with a credit card. No credit score required to apply. · No Annual Fee, earn cash back, and build your credit history. · Your secured credit card requires a refundable security. Secured credit cards require a one-time, refundable security deposit used as collateral. Your deposit is often equal to the credit limit. If you don't have. The U.S. Bank Secured Visa® credit card is perfect for a first-time credit card to start building credit or rebuilding credit. Learn more and apply today. Winner: Neo Secured Mastercard Neo Secured Mastercard allows you to start with as little as $50 in security funds, bypassing hard credit check. That's because. First Progress Platinum Elite Mastercard® Secured Credit Card · Choose your own credit line – $ to $ – based on your security deposit · Build your credit. Apply for the BankAmericard® secured credit card to start building your credit and enjoy access to your FICO® Score updated monthly for free. These cards require a cash collateral deposit which serves as a credit line for the account. With secured cards credit issuers will report your payment history. Apply for a secured credit card. You'll make a cash deposit into a savings account. This deposit acts as collateral for charges you make on the card. For. Best for rewards: Discover it® Secured Credit Card · Best for a low deposit: Capital One Platinum Secured Credit Card · Best for high potential credit limit. Citi® Secured Mastercard® is an option for customers with little or no credit history and can help you build your credit when used responsibly. Unlike a debit. The easiest credit card to get with bad credit is a secured credit card with no credit check such as the OpenSky® Plus Secured Visa® Credit Card. No credit. Best for prequalification: Credit One Bank® Platinum Visa® for Rebuilding Credit Here's why: If you have your heart set on an unsecured credit card but you're. Secured credit cards function a lot like traditional credit cards. The primary difference is that with a secured card, you pay a cash deposit upfront to. Citi® Secured Mastercard®: Best feature: No annual fee. · Discover it® Secured Credit Card: Best feature: Secured purchases. · Capital One Platinum Secured Credit. If you have bad credit, your best bet will likely be a secured credit card. Unlike traditional credit cards, secured cards require a security deposit — usually. Poor credit? Choices are limited and tend to have relatively high APRs and charge fees. A secured card may be a good option if your score is in this range. Start with a Credit Builder Account* that reports to all 3 credit bureaus. · Make at least 3 monthly payments on time, have $ or more in savings progress in. The TD Cash Secured Visa Credit Card is a great way to build or repair credit, earn cash back, plus fraud protection, online banking & more.